In this briefing:

- Last Week in GER IPO Research: Leong Hup, China Tobacco, Futu and Weimob

- 2018 HK-Connect SouthBound In a Nutshell

- Apple (AAPL): Reduces Prices in Mainland China – Right Action, But Not Enough

- China Kepei Edu (科培教育) IPO – Regulation Poses Significant Near-Term Risks

- Ten Years On – Asia’s Time Is Coming, Don’t Miss The Boat

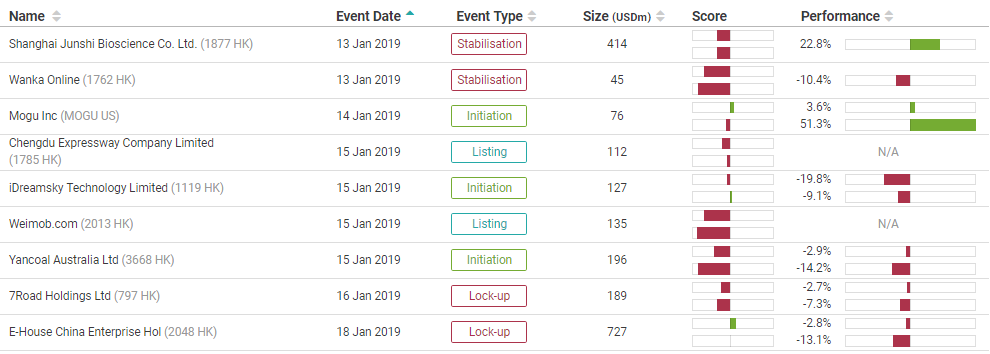

1. Last Week in GER IPO Research: Leong Hup, China Tobacco, Futu and Weimob

We slide into 2019 with GER’s recap of our latest IPO research. This week, we talk chicken as Arun initiates on the IPO Malaysian poultry producer Leong Hup International (LEHUP MK). Secondly, Venkat initiates on China Tobacco International (GHALPZ CH) with a cautious view. In addition, Arun initiates on online broker Futu Holdings Ltd (FHL US) and we remind of Arun’s valuation piece on Weimob.com (2013 HK) .

Quote of the week

Are you insane?

-Sky news presenter to UK MP Boris Johnson ahead of the Brexit parliament vote planned for today

Best of luck for the week and new year- Rickin, Venkat and Arun

2. 2018 HK-Connect SouthBound In a Nutshell

Since autumn of 2014, the HK-Shanghai Connect, and later the HK-Shenzhen Connect mechanisms have provided means for mainland investors to buy Hong Kong-listed stocks.

We have been tracking the H/A relationships and the Southbound flows per name on a weekly basis and occasionally writing commentary about it since late 2016.

This report provides a brief synopsis of the SOUTHBOUND flows into Hong Kong-listed stocks over the course of 2018, by sector, by average percentage change in mainland ownership of HK shares outstanding subject to the Connect mechanisms, and the top and bottom five names per sector per quarter.

3. Apple (AAPL): Reduces Prices in Mainland China – Right Action, But Not Enough

- Tim Cook passed the buck to the weak sales in China. However, we believe China’s retailing is running well based on our visits to shopping malls with Apple stores.

- Luxury goods sold better in China than all other major markets in the world in 2018.

- We believe that the price reduction in Mainland China is just taking market share from Apple Stores in Hong Kong, but not from competitors.

- We also believe that the app review process is the fatal shortcoming for AAPL.

4. China Kepei Edu (科培教育) IPO – Regulation Poses Significant Near-Term Risks

China Kepei Education (1890 HK) is looking to raise up to US$122m in its upcoming IPO.

Overall, the company has continued to show that its undergraduate program is the driver behind its growth. It grew its 8M 2018 revenue and gross profit both by about 24% YoY. However, there are significant near-term risks if the MOJ Draft for Comments gets implemented. It may result in Kepei registering its schools as for-profit private schools which would shrink its net profit margin.

In this insight, we will provide updates on the company’s 8M 2018 financials and operating performance, the potential impact of policy change and compare its valuation to other listed education peers. We will also run the deal through our framework.

5. Ten Years On – Asia’s Time Is Coming, Don’t Miss The Boat

We noted in Ten Years On – Asia Outperforms Advanced Economies Asia’s economies and companies have outperformed advanced country peers in the ten years to 2017. Growing by 6.8%, real, through the crisis the region is 188% larger in US dollar terms while US dollar per capita incomes 170% higher compared with 2007. In this note we argue even though Asian stock markets have underperformed since 2010 and the bulk of global capital flows have gone to advanced countries, Asia’s time is coming. Valuations are cheap. Growth fundamentals strong. There are few external or internal imbalances. Macroeconomic management has been better than in advanced economies and the scope to ease policy to ward off headwinds in 2019 is greater. China has already started.

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.