In this briefing:

- IQiyi (IQ): In 4Q18, Baidu’s Growth Engine Lost Control Over Content Cost

- Sharp MoM Decline In January Semi WFE Sales Casts A Spanner In Second Half Recovery Works.

- HK Connect Discovery Weekly: Geely, Great Wall Motor and Sands China (2019-02-22)

- Hopewell’s Egregiously Bad Offer, But What Can You Do?

- Yincheng Intl (银城国际) IPO Quick Note: A Highly Levered Nanjing Developer Bet

1. IQiyi (IQ): In 4Q18, Baidu’s Growth Engine Lost Control Over Content Cost

- We notice that the growth rate of cost of revenues exceeded the growth rate of membership revenues.

- We believe that the margins will continue to decline even if the advertising business recovers.

- IQ has the largest monthly active users in the video market, but it does not have an obvious advantage over Tencent Holdings (700 HK) .

2. Sharp MoM Decline In January Semi WFE Sales Casts A Spanner In Second Half Recovery Works.

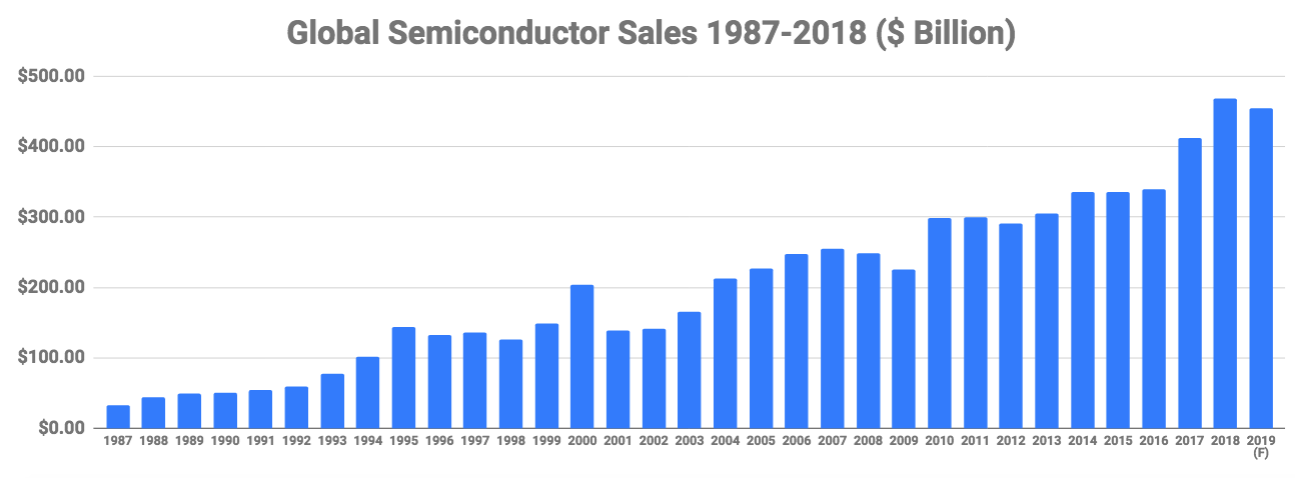

According to SEMI, North American (NA) WFE sales for January 2019 fell to $1.9 billion, down ~10% sequentially and ~20% YoY. This was an abrupt reversal of the recovery trend implied by the December 2018 sales of $2.1 billion and is the biggest monthly sales YoY decline since June 2013.

Just as declining monthly WFE sales preceded the current semiconductor downturn by some six months, the continuation of December’s MoM WFE decline reversal trend was a prerequisite for a second half recovery in the broader semiconductor sector. With that trend well and truly broken, we now anticipate a more delayed, gradual and prolonged recovery, one which is now unlikely to materialise until late third, early fourth quarter 2019.

3. HK Connect Discovery Weekly: Geely, Great Wall Motor and Sands China (2019-02-22)

In our Discover HK Connect series, we aim to help our investors understand the flow of southbound trades via the Hong Kong Connect, as analyzed by our proprietary data engine. We will discuss the stocks that experienced the most inflow and outflow by mainland investors in the past seven days.

We split the stocks eligible for the Hong Kong Connect trade into three groups: component stocks in the HSCEI index, stocks with a market capitalization between USD 1 billion and USD 5 billion, and stocks with a market capitalization between USD 500 million and USD 1 billion.

In this week’s HK Connect Discovery, we highlight the strong inflow to automobile stocks and Sands China.

4. Hopewell’s Egregiously Bad Offer, But What Can You Do?

The Scheme Document for the privatisation of Hopewell Holdings (54 HK) has been dispatched. The court meeting will be held on the 21 March. The consideration will be paid (on or before) the 14 May. The IFA (China Tonghai Capital) considers the $38.80/share Offer to be fair & reasonable. The Scheme is conditional on ≥75% for, ≤10% against from disinterested shareholders. As Hopewell is HK-incorporated, there is no “head count ” test. The full timetable is as follows:

Date | Data in the Date |

6-Dec-18 | Announcement |

24-Feb-19 | Scheme document |

13-Mar-19 | Last time for lodging shares to qualify to vote |

15-Mar-19 | Meeting record date |

19-Mar-19 | Court/EGM meeting |

2-May-19 | Effective date |

14-May-19 | Cheques dispatched |

Substantial Shareholders | Mn | % |

The Wu family & concert parties | 320.7 | 36.93 |

Non-consortium Offeror concert parties | 31.7 | 3.65 |

Total | 352.5 | 40.48 |

Disinterested Shareholders | 516.1 | 59.42 |

After hearing conflicting opinions on what constitutes a blocking stake, a chat with the banker confirmed the blocking stake, as per the Companies Ordinance, is tied to 63.07% of shares out (i.e. Scheme shareholders – see page 95); whereas the Takeovers Code is tied to 59.42% of shares out. Effectively there are two assessments on the blocking stake and the more stringent (the 59.42% out in this case) prevails.

With the Offer Price representing a 43% discount to NAV, wider than the largest discount precedent in past nine years (the Glorious Property (845 HK) offer, which incidentally was voted down), the IFA creatively argues that extenuating factors such as the premium to historical price needs to also be taken into account. Hardly original, but that is where investors must decide whether this is as good as it’s going to get – given the Wu family’s control, there will not be a competing offer – or to hold out for a superior price longer term. This is a final offer and it will not be increased.

What the IFA fails to discuss is that the widest successful discount to NAV privatisation was 29.4% for New World China Land (917 HK) in 2016. And all precedent transactions (successful or otherwise) are PRC (mainly) property development related; except for Wheelock which operated property in Hong Kong (like Hopewell) and in Singapore, which was privatised at a 12.1% discount to NAV.

Therein lies the dilemma – what is a fair and reasonable discount to NAV for a Hong Kong investment property play? With limited precedents, it is challenging to categorically reach an opinion. And that is the disingenuous conclusion from the IFA that the premium to last close and with reference to historical pricing, is in effect the overriding reason to conclude the Offer is reasonable. I would argue the Wu family has made a low-ball offer for what is essentially an investment property play with quantifiable asset value.

A blocking sake is 5.9% or 51.6mn shares. First Eagle, which recently voted down the Guoco Group Ltd (53 HK) privatisation that was pitched at a ~25% discount to NAV, holds 2.7% (according to CapIQ).

Trading at a wide gross/annualised return of 7%/37.5%, reflecting the risk to completion, and the significant downside should the scheme be voted down. Tough one – the premium to last close and with reference to the 10-year price performance, should be sufficient to get it over the line, and the basis for this “bullish” insight. But only for the brave.

5. Yincheng Intl (银城国际) IPO Quick Note: A Highly Levered Nanjing Developer Bet

Yincheng International, a China Yangtze delta focused property developer, is raising up to USD 110 million to list on the Hong Kong Stock Exchange. In this note, we will cover the following topics:

- The company’s property portfolio

- Financial performance that concerns us

- Shareholders and use of proceeds

- Our view on the deal

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.