In this briefing:

- Fortis Healthcare: OK Results and a Cost-Cutter CEO

- New J. Hutton Exploration Report (Week Ending 15/02/19)

- Sell Bombardier: Core EBIT Fell, Core Cashflow Is Negative, Covenants Maybe Under Stress

- Singtel’s Weak 3Q18 Results but Dividend Looks Sustainable and Long Term Upside from Associates

1. Fortis Healthcare: OK Results and a Cost-Cutter CEO

Fortis Healthcare (FORH IN) ‘s hospital business continued to improve in FQ3 while the lab business remained stable. This Insight briefly focuses on the highlights of the results and their implications. The hiring of a CEO out of Narayana Hrudayalaya (NARH IN) signals continued (and likely intensified) focus on efficiency to improve profitability.

We continue to think that Fortis is a promising turnaround story. Refer to the Insight Stream for the history of this situation.

2. New J. Hutton Exploration Report (Week Ending 15/02/19)

- Gold Road Resources (GOR AU) continued strong BUY

- Mineral Resource increased 2% to 6.61Moz

- 2019 attributable production guided at 50–60koz Au

- AISC est. between A$1,050 to $1,150/oz, is realistic

- Using $1,300/oz attributable 2019 EBIT will be between US$7.5-15m

- 2020 attributable EBIT of 150k/oz conservative $A54m

- Price/EBIT ratio now 10.9 to 16.8 (previous est. 8 to 9.1)

- Expand AIM & ASX coverage to 397 companies from next week

- Gold Road Resources (GOR AU), Azumah Resources (AZM AU), Millennium Minerals (MOY AU), Metals X Ltd (MLX AU), De Grey Mining (DEG AU) , Resolute Mining (RSG AU), Andromeda Metals (ADN AU)

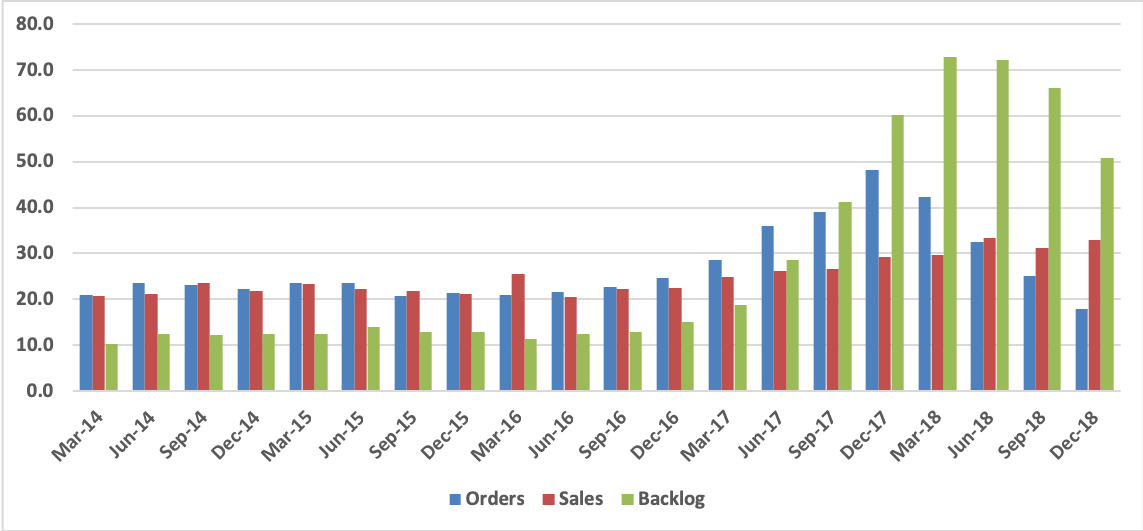

3. Sell Bombardier: Core EBIT Fell, Core Cashflow Is Negative, Covenants Maybe Under Stress

Core EBIT fell: FY2018 EBIT and cashflow were inflated by one-off gains.

Core cashflow remains negative: Bombardier Inc (BBD/B CN) is still unable to fund its annual US$1bn+ capex budget from core operating cashflow.

Covenants maybe under stress: We are very concerned that the consolidated capital structure presented to investors is very different to the structures used in their debt covenants.

4. Singtel’s Weak 3Q18 Results but Dividend Looks Sustainable and Long Term Upside from Associates

Singtel (ST SP) recent 3Q18 results were relatively lackluster. Singapore revenue trends were encouraging, but EBITDA remains under pressure esp in the Enterprise segment. Optus saw good net subscriber additions, but this came at a cost – lower ARPU and mobile service revenue (MSR). We have lowered our forecast to reflect pressure on EBITDA and continued losses in Group Digital Life (GDL) but maintain a BUY on the stock with a target price of S$4.00. The near 6% dividend yield is the key support and we believe it can continue to be paid without resorting to increased leverage. Longer term, the fate of key associates (India and Indonesia in particular) are key to the stock’s performance

Get Straight to the Source on Smartkarma

Smartkarma supports the world’s leading investors with high-quality, timely, and actionable Insights. Subscribe now for unlimited access, or request a demo below.